Understanding ZELLE Fraud & Scams

As a consumer, it’s important to understand how fraud and scams are defined because there may be differences in the consumer protections offered by your bank or credit union. A basic way to differentiate fraud and scams is unauthorized vs. authorized transactions.

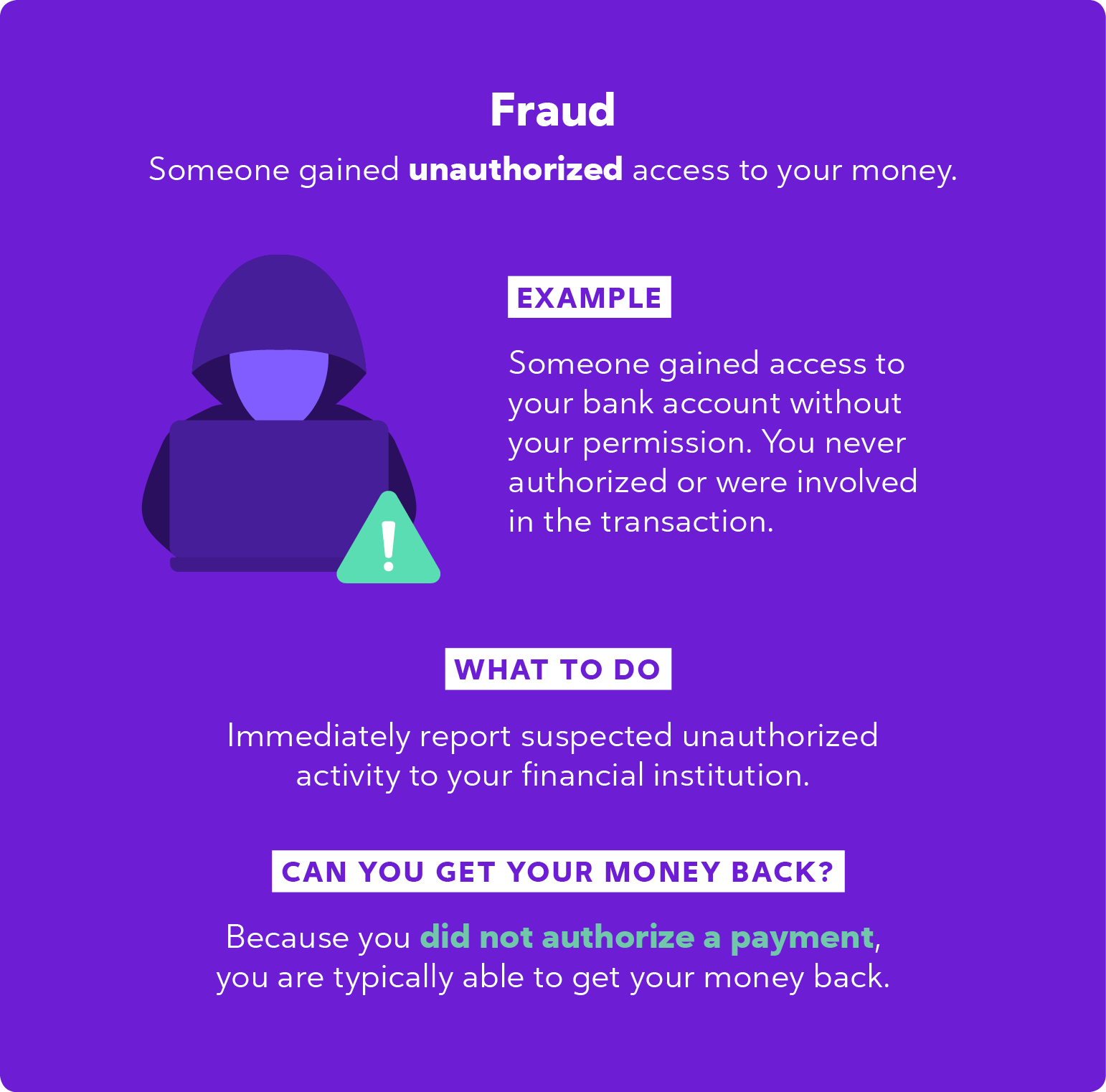

FRAUD

If someone gained access to your bank account and made a payment with Zelle® without your permission, and you weren’t involved in any way with the transaction, this is typically considered fraud since it was unauthorized activity. If someone gained access to your account, and stole money or sent it without your permission, this could be defined as fraud. Immediately report suspected unauthorized activity to your local branch. Because you did NOT authorize a payment, you are typically able to get your money back after reporting the incident.

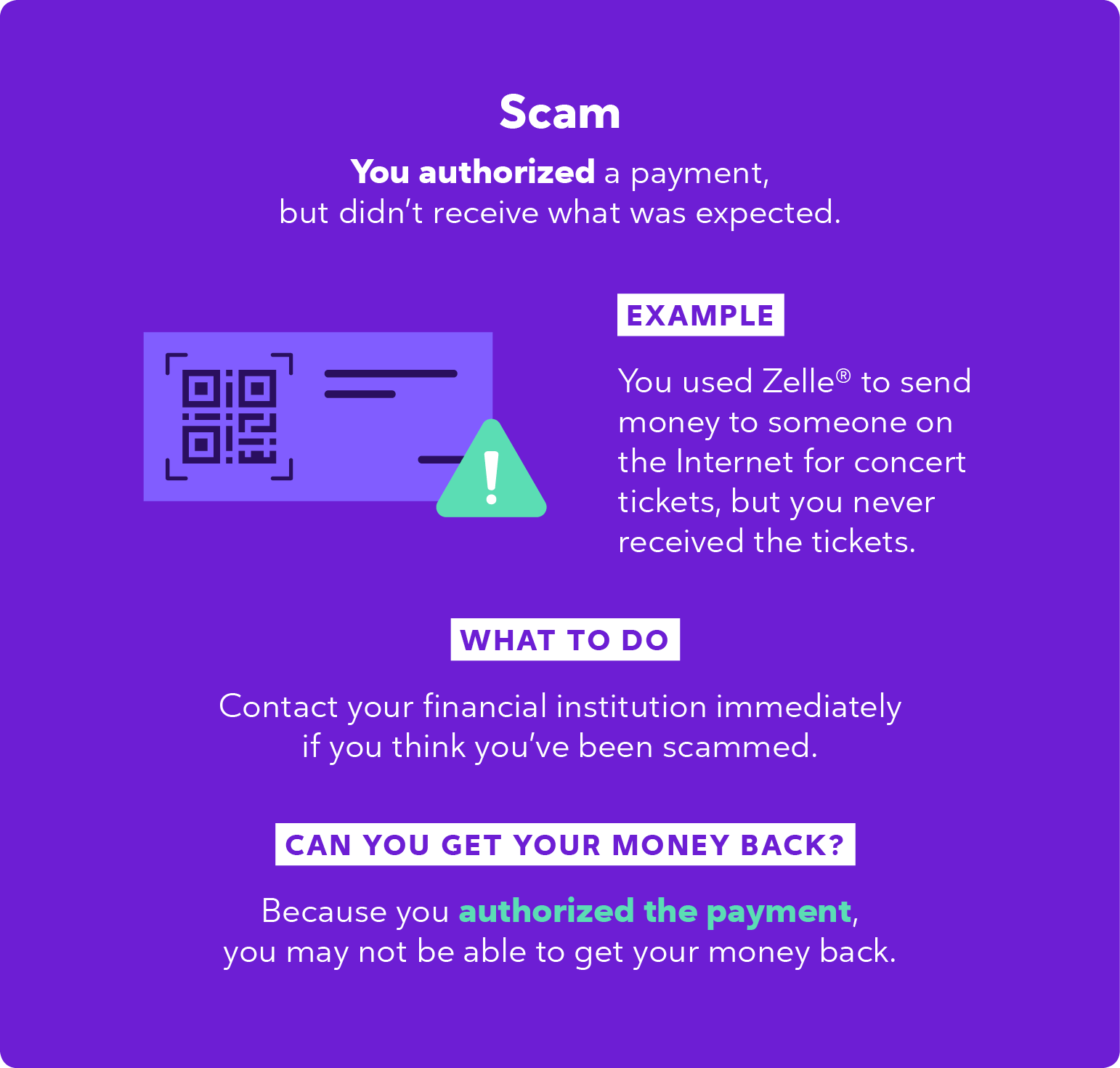

SCAM

If you were knowingly involved in the transaction and you gave the “ok” and authorized a payment to be sent, this is typically defined as a scam. Even if you were tricked or persuaded into authorizing a payment for a good or service someone said they were going to provide, but they didn’t fulfill it, this would be considered a scam. Because you authorized the payment, you may not be able to get your money back.

Contact Your local Madison County Bank location for Possible Recourse

Get in touch with us immediately if you feel you’ve been the victim of fraud or have been scammed. In cases of unauthorized payments, consumers have legal rights and protections under the Electronic Funds Transfer Act (also known as "Reg E”). It’s important to read the user service agreement and the account agreement with to understand the terms of any payment service you intend to use.